is an inheritance taxable in michigan

The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate. Like the majority of states Michigan does not have an inheritance tax.

Is Your Inheritance Considered Taxable Income H R Block

Fill out and file a probate petition with the Michigan probate court in your area.

. How do you transfer a property deed from a deceased relative Michigan. Taxable income is all income subject to Michigan individual income tax. A benefactor pays inheritance tax after receiving his or her portion of the assets.

The Probate Process in Michigan. For individuals who inherited from a person who passed away on or before September 30 1993 the inheritance tax remains in effect. What Does In Respect of a Decedent Mean.

If you own property in Michigan and live in. You may think that Michigan doesnt have an inheritance tax. Thats because Michigans estate tax depended on a provision in the Internal Revenue Tax Code.

If you inherit property that is located in a state that has an inheritance tax you would be required to pay it unless you are exempt. Reporting inheritance income in respect of a decedent includes gross income items. Is there still an Inheritance Tax.

For most people there is no concern about Michigan estate or death taxes. The Michigan inheritance tax was eliminated in 1993. Michigan does not have an inheritance tax.

What is an Inheritance Tax. An inheritance tax is a tax on the right to receive property by inheritance. You can inherit cash land vehicles stocks money that was saved in a retirement account rental property a business equipment a payout from a life insurance policy and so on.

View a list of items included in Michigan taxable income. The states that have inheritance taxes are Pennsylvania New Jersey Maryland. The economic impact payments are not included in federal adjusted gross income AGI or in Michigan taxable income.

Most probate transfers are nontaxable but please check with a Michigan attorney to confirm NOTE. The use of the Internet for communications with the firm or this attorney will not establish an attorney-client relationship and messages. If you indicate which state you are resident of I can confirm whether you have an inheritance tax issue.

Many times an inheritance will include a mixture of different assets that were saved and accumulated in different ways. After much uncertainty Congress stabilized the Federal Estate Tax also known as the death tax. We practice in Michigan and there is no inheritance tax in our state but this does not necessarily mean that you should have no concerns at all.

How much or if youll pay depends upon where the annuity came from and how much its worth. Although Michigan does not impose a separate inheritance or estate tax on heirs you may have to pay state taxes on your annuity income. Anything over that amount is taxed at 40.

As you can imagine this tax can have a big impact when leaving a significant estate to your heirs. As you can imagine this tax can have a big impact when leaving a significant estate to your heirs. Whether you receive money that was in a.

Its estate tax technically remains on the books but since 2005 there has been no mechanism for it to collect it. However the state in which you reside may have an inheritance tax if you live in a state other than MI. However if the inheritance is considered income in respect of a decedent youll be subject to some taxes.

Maryland is the only state to impose both. Michigan does not have an inheritance tax. Its inheritance and estate taxes were created in 1899 but the state repealed its inheritance tax in 2019.

Only six states Iowa Kentucky Maryland Nebraska New Jersey and. An inheritance can be a windfall in many waysthe inheritor not only gets cash or a piece of property but doesnt have to pay income. Regarding your question Is inheritance taxable income Generally no you usually dont include your inheritance in your taxable income.

A beneficiary or heir could conceivably be taxed if an asset is discovered years later but the decedent died on or before this date. If you stand to inherit money in Michigan you should still make sure to check the laws in the state where the person you are inheriting from lives. Michigan does not have its own Estate Tax however your estate may be subject to Federal Estate Taxes depending on its size.

Where do you pay inheritance tax in the US. Different rules might apply due to the inheritance tax. In Pennsylvania for example the inheritance tax can apply to heirs who live out of state if the descendant lives in the state.

Michigan does not have an estate tax. In most cases your inheritance is not taxable. You will pay 000 in taxes on the first 1170000000.

This list serves as a guide and is not intended to replace the law. Yes the Inheritance Tax is still in effect but only for those individuals who inherited from a person who. Homestead Property Tax Credit.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. MCL 20630 Note. Michigan does not have an inheritance tax with one notable exception.

The Michigan estate taxreturn picks up the maximum allowable credit amount fromthe US. The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate. It does have an inheritance tax but only for bequests made by decedents who died on or before September 30 1993.

An inheritance tax is a tool that governments sometimes use to tax assets that people get as part of an inheritance. The Michigan inheritance tax was eliminated in 1993. As of 2021 you can inherit up to 1170000000 tax free.

Technically speaking however the inheritance tax in Michigan. Inheritance and Estate Tax. Its applied to an estate if the deceased passed on or before Sept.

Michigan does not have an inheritance tax. The proposal would eliminate Michigan state taxes on 401k withdrawals and pension income. While the Michigan Inheritance Tax no longer exists you may be subject to the Michigan Inheritance Tax if you inherited an asset from an estate prior to 1993.

Died on or before September 30 1993. Michigan doesnt have an inheritance or estate tax.

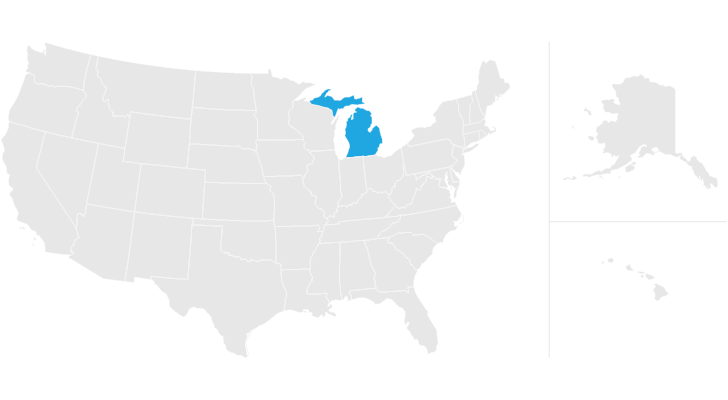

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Is There An Inheritance Tax In Michigan Axis Estate Planning

Michigan Estate Tax Everything You Need To Know Smartasset

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Onl Inheritance Tax Estate Tax Nightlife Travel

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Onl Inheritance Tax Estate Tax Nightlife Travel